For the past few decades, China has been tapping its 9.6 million square kilometers of geography for energy-generating natural resources. Recent news has focused on the 1,000+ coal-fueled power plants that popped up. But China has also invested in renewable energy infrastructure on a massive scale, including mammoth hydroelectric plants, vast wind farms, and a small horde of solar plants.

Unfortunately, China’s richest veins of energy resources—coal, wind, hydro, solar—are found in remote corners of the country. So there is a significant geographical mismatch between power plant location and major population centers. China’s hydropower is concentrated in the southwest provinces of Sichuan, Yunnan, and Tibet. And its most productive coal plants and wind/solar plants reside in northern provinces. But the most energy-hungry urban and industrial centers sit thousands of miles away on the southern and eastern coasts.

Physical distance does no favors for electricity. It’s expensive to build the heavy-duty high-voltage lines required to transport electricity over long distances, and those lines are extremely inefficient to boot. Electricity begins to decay as soon as it leaves its generator, and continues to dissipate, more and more, all along it’s journey down the line. (If you need the science, ask a physicist to explain Ohm’s law).

Until China is able to connect its remote electricity plants with its population centers with a web of high-voltage lines, those plants have to deal with massive amounts of electricity surplus. And how do power plant operators deal with a massive surplus in electricity? They send it all to spoil. Or, to use the industry jargon, the surplus gets curtailed. At one point (circa 2016-2017), China was curtailing more wind and hydropower than most countries consume.

At some point, either the hydroelectric plant operators, or local officials, or whoever had the authority grew tired of watching so much perfectly good electricity go to waste. The genius solution was to wire up a fleet of Bitcoin mining rigs and convert the would-be-wasted electricity into a productive, lucrative venture.

Lessons for the Future

That story is conspicuously missing from the clamor over the Bitcoin network’s energy usage. Probably because it so thoroughly negates the points naysayers are trying to make, namely the idea that Bitcoin is using energy from carbon dioxide spewing plants, or that Bitcoin is hogging electricity that some underserved population desperately needs.

I’m not saying that China staked out 75% of the hashrate in the Bitcoin network, solely on renewables destined for curtailment, but it was definitely a contributing factor. And there’s plenty of evidence to suggest that the energy mix consumed by Bitcoin miners in China skewed toward renewables rather than matching the coal-heavy consumption mix from the country as a whole.

Of course, this entire debate is old news already. China announced a prohibition on Bitcoin mining, in mid-2021, and “The Great Migration” of Bitcoin miners is underway. As the network re-distributes itself around the world, there is a profusion of lucrative matches waiting to be made between enterprising companies and energy going to waste. After all, China isn’t the only country that curtails mind-bending amounts of electricity.

Energy Waste is a Huge Problem

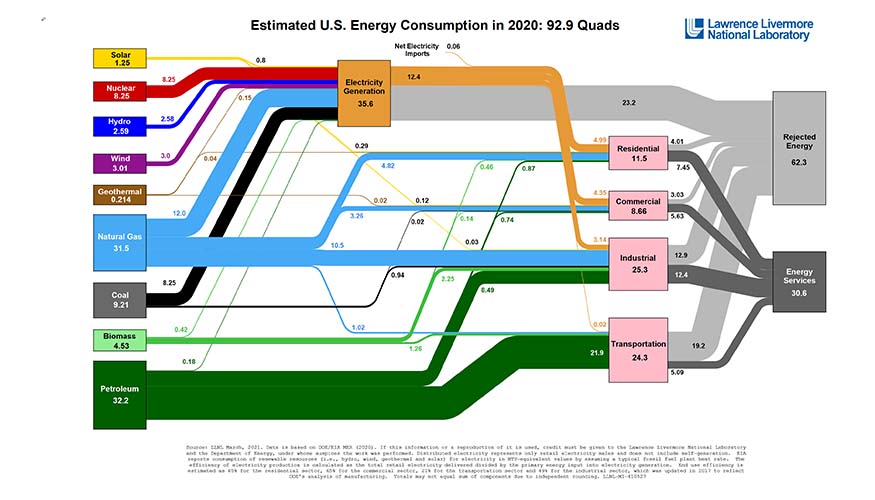

According to the Lawrence Livermore National Laboratory (above), 62% of the United States’ energy consumption was rejected (i.e. wasted) energy. Some of that waste can be attributed to byproducts like the heat that emanates from lightbulbs, or the heat in the exhaust produced by automobiles and factories. But a significant portion of wasted energy comes from power grids simply curtailing energy.

Curtailment is happening across the board—nuclear, wind, hydro, coal, solar, geothermal, etc.—and for a variety of reasons—keeping the prices high, grid emergencies, an overabundance of supply, seasonal demand adjustments, and more. Installing Bitcoin miners to suck up as much of that wasted energy as possible is a solution that checks a lot of those boxes.

An Alternate Solution… for the Haters

I think a sizable portion of the Bitcoin energy backlash is coming from people who think Bitcoin and other cryptocurrencies are an extravagance, undeserving of any of society’s resources. Obviously, this post is not for them. But I don’t mind pointing out that Bitcoin mining isn’t the only solution for wasted energy.

Iceland is another country rich in natural, renewable energy. Sitting on the Mid-Atlantic Ridge plate boundary, the island nation is bursting with geothermal energy—there are over 200 volcanoes and over 600 hot springs! Iceland’s geography is also abundant with glacial rivers and waterfalls, perfect for hydropower.

Although not even close to tapping into its full potential as an energy producer, Iceland generates much more electricity than it’s sparse population needs. And due to its geographical isolation, there aren’t any close neighbors to purchase the surplus. Not happy to see so much good energy go to waste, officials came up with a solution: build a few aluminum smelters.

Aluminum smelting is an extremely electricity-intensive process, so courting metals companies with cheap, renewable energy wasn’t a difficult process. The smelters powered through the economic collapse in 2008, and aluminum exports easily overtook fishery exports, the Icelandic economy’s previous top producer.

But aluminum production is a heavy industry. Factories are bulky and sometimes dangerous. And adding a remote island into the production/supply chain is inefficient—needing to ship raw ore across the ocean to be processed and then shipping the extracted aluminum back around the world. Which is why Iceland found an entirely new industry to plug into its renewable grid: data.

The move to large-scale computing was a natural fit. Data centers happen to thrive in Iceland’s chilly climate, where they can be cooled naturally by simply opening some doors—the average annual temperature hovers a bit above freezing. Up to this point, hundreds of thousands of computers have already been installed on the island where they can efficiently and affordably store data, perform supercomputations, and even mine Bitcoin.

Sorry for the bait-and-switch, but the Iceland example turns out to be another feather in Bitcoin mining’s cap. While there are plenty of other industries that can benefit from surplus energy, crypto mining is almost always going to be more convenient, and leave a smaller footprint. Sure, mining hardware is electricity-hungry. But when it comes to energy waste, that’s a feature, not a bug.

Modular Mining And Other Benefits

Bitcoin mining on a large scale isn’t the only use case here. A mining operation can also be portable, modular, and accept flexible energy loads. Portable miners can be plugged into places where nothing else even makes sense. Here’s an example:

The oil drilling process produces a significant amount of methane gas as a waste product. Because oil wells aren’t usually connected to natural gas pipelines, however, all that methane gets flared—in other words, lit on fire like a giant flamethrower aimed at the sky. It’s a waste of a perfectly good energy resource, and it adds methane and CO2 into the atmosphere (on windy days, methane especially).

Obviously, you can’t strap an aluminum factory to an oil rig, but you could hook up a generator and a couple of Bitcoin miners and make a tidy profit, all while reducing greenhouse gas emissions. I know it sounds like a pie-in-the-sky contraption, but there are serious companies actively doing this. Even Texas Sen. Ted Cruz gave it a mention at the Texas Blockchain Summit:

“Fifty percent of the natural gas in this country that is flared, is being flared in the Permian right now in West Texas. I think that is an enormous opportunity for bitcoin, because that’s right now energy that is just being wasted. It’s being wasted because there is no transmission equipment to get that natural gas where it could be used the way natural gas would ordinarily be employed; it’s just being burned.”

More Waste In, Less Waste Out

Sure, the Bitcoin network will always use some grid energy to some extent. In that way, it’s no different from any other aspect of modern human industry. And Bitcoin mining operations will always prefer a steady flow of electricity, particularly when it comes to the profitability of expensive new hardware. (Although, when push comes to shove, miners can deal with interruptions without catastrophe, unlike hospitals or cloud storage servers or many manufacturing operations.)

But there is still so much room for Bitcoin mining in the nooks and crannies of the energy sector that comes at zero extra cost to the grid or the environment. Especially when it comes to older mining units, the ones that lose their place to next-gen hardware. Rather than scrap the outdated hardware as soon as grid energy is no longer profitable, why not allow them to soak up even the intermittent energy that gets curtailed?

Run them at night in the nuclear plant, when the rest of the grid is asleep. Send surplus hydro power their way when the spring waters are pumping from glacial melt off. Send them to wind farms and solar plants and oil rigs and remote grids with low-demand. We can mitigate two types of waste here, with a single, lucrative solution.

21 thoughts on “Bitcoin Isn’t the Culprit Behind Energy Waste, but It Is One of the Solutions”

This is an interesting topic. 😍

Amazing write-up!

Nice info!

Brilliant Idea!!!

This is amazing! This is one of the best blogs on the net. I’m going to recommend your blog!

I LIKE IT!!!! THANKS FOR THIS.

Good Post! Thanks for sharing🙂

What a great info, it’s interesting!

Daven, I am so impressed by your work!

Great!! This will help a lot. Thanks!

Lovely web journal, Daven– thank you for sharing!

Daven, a friend forwarded me your web journal and I am truly delighted in it.

Very nice post.

Excellent article!

I will recommend this to my friends and co-workers. Great Blog!!!

Great idea! This will help a lot!

Amazing idea 😃 thank you for sharing!

I agree with you Anne.

Excellent idea! Thanks for this 🙂

This is new to me and I love the Idea, I can recommend this to my family, friends and colleagues in work.

Excellent information.